Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

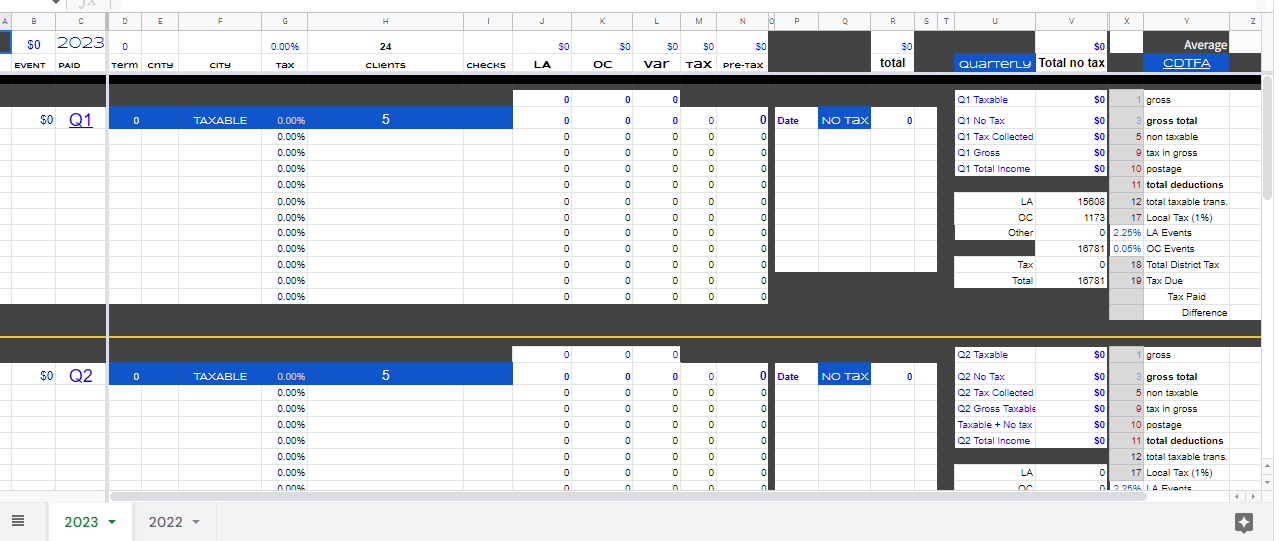

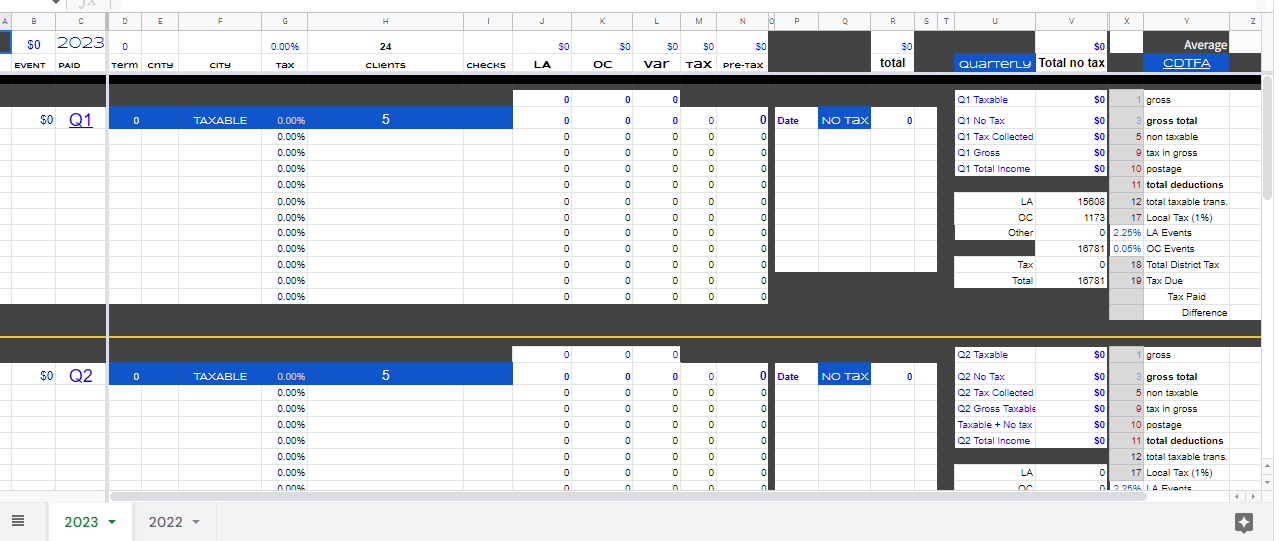

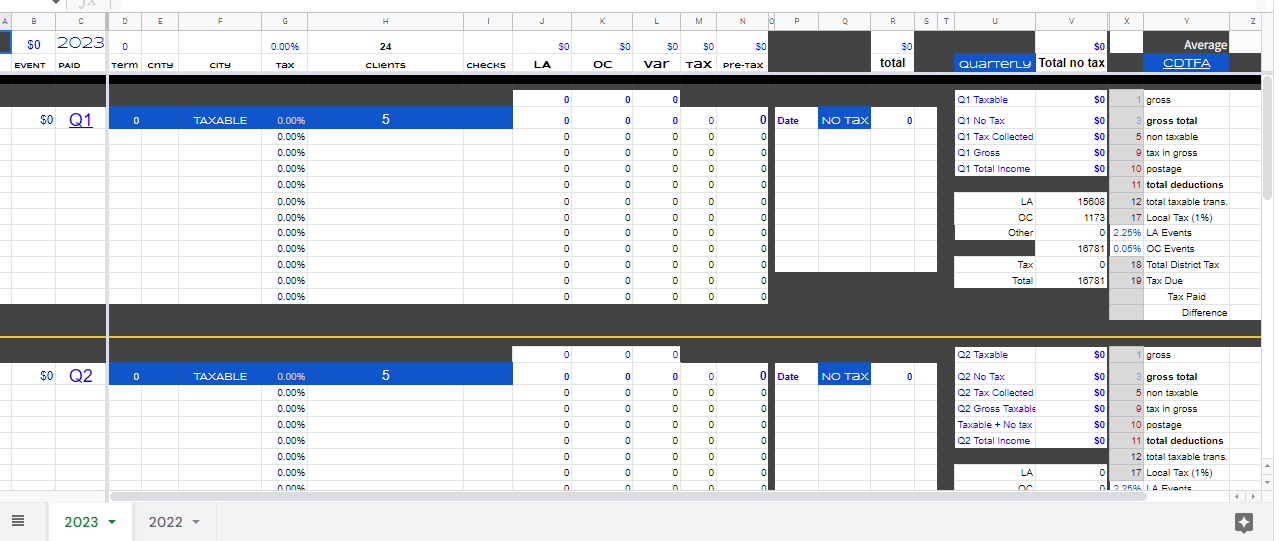

Business Taxes Log for Quarterly Estimated Taxes and FICA - Small Business Tax Log Template

If you’re business requires you to collect and remit sales taxes. Then this Sales and Use Tax Log and Quarterly Tax Estimator can streamline the 'income process.' The calculator calculates your tax liability and simplifies the tax reporting process, ensuring you comply with applicable tax laws.

If you’re business requires you to collect and remit sales taxes. Then this Sales and Use Tax Log and Quarterly Tax Estimator can streamline the 'income process.' The calculator calculates your tax liability and simplifies the tax reporting process, ensuring you comply with applicable tax laws.

For example, California taxes catering events by the city where the event occurred, not the catering business's headquarters or store location. Catering events throughout the city could mean hundreds or thousands of dollars of improperly remitted tax without accurate record-keeping. It also helps to look back and see the transaction's "story." And often, the Sales and Use Tax Collection Board of California (CDFA) calls and asks for records from several years ago.

With this tool, you can see what occurred and how you handled it. This calculator helps you calculate the sales tax on each transaction. Triangulating this information would have been challenging otherwise. You will need to enter the total amount of the sale, the applicable tax rate, and any applicable exemptions or deductions. The calculator will then provide you with the sales tax you owe per transaction.

A use tax calculator works similarly but assists you with out-of-state vendors not required to collect sales tax. In these cases, you are responsible for paying use tax on the purchase, typically calculated at the same rate as the local sales tax.

In addition to these calculators, it's also essential to keep a detailed sales and use tax log. This log should include all sales transactions made by your business, including the date of the sale, the amount of the sale, the applicable tax rate, and any exemptions or deductions. This log can also include details about your use tax liabilities, including the vendor name, date of purchase, and total purchase price.

By tracking all of your sales and use tax transactions in one place, you can easily calculate your total tax liability and provide accurate information to your tax preparer or when you need to look back historically.

Additionally, a sales and use tax log can help you identify errors or discrepancies in your tax reporting or bookkeeping. If you notice any inconsistencies in your log, you can take steps to correct them before they become more significant problems. A tax log can also help you identify patterns in your business's sales and use tax liabilities. By tracking your tax liabilities over time, you can identify trends or areas where you can reduce your tax liability.

FAQ about Sales and Use Logs and This Tool

How do I know the local city tax rate for my event?

A quick Google search will also tell you the answer. Drop the rate in this log line, and it will track it.

Why is it important to track your business sales?

As a business owner, a sales and tax log keeps track of your transactions and is hugely important. You can use this log to track your expenses, estimate your taxes, and crosscheck your formal accounting.

What does a sales and use tax log even do?

If you receive a lot of checks or you have a business that receives intermittent sales, you need a way to keep track of what business you have done in the quarter and estimate what you will owe in estimated taxes. A sales and tax log records all your sales and tax transactions, including the transaction date, the sale amount or purchase, the applicable tax rate, and exemptions or deductions. By keeping a detailed log of your sales and tax transactions, you can calculate your tax liability and provide accurate information to your tax preparer.

What are the key benefits of a sales and use tax log?

One of the key benefits of a sales and tax log is that it can help you track your expenses. By recording your business expenses in one place, you can easily see where your money is going and identify areas where you can reduce your costs. This information can be beneficial when it comes time to prepare your tax return, as you can deduct many of your business expenses from your taxable income. You can also use a sales and tax log to estimate your taxes. By tracking your sales and tax transactions, you can calculate your total tax liability and ensure you set aside enough money to pay your taxes, which is extraordinarily helpful for new businesses or those with irregular income streams.

Sales and tax logs also serve as a crosscheck for your formal accounting. By comparing your sales and tax log to your formal accounting records, you can ensure that your accounting is accurate. When creating a sales and tax log, it's essential to include all the necessary details for each transaction: the transaction date, the sale or purchase amount, the applicable tax rate, and any exemptions or deductions.

What is a Tax calculator?

A tax calculator is a helpful tool for estimating your sales and use tax liability. This tool will consider the tax rate, the number of taxable sales, and any exemptions or deductions. Some popular tax calculators charging a monthly fee include TaxJar and Avalara. Low-cost, one-time purchase calculators like Conscious Bean's Sales and Use Log don't require a recurring cost.

What is a Gross sales log?

A gross sales log records all your business's sales, including the sale date, the sale amount, any applicable sales taxes or exemptions, and more. A detailed gross sales log can help you stay organized and prepare for tax season.

What is a Gross sales calculator?

A gross sales calculator helps you quickly determine your total gross sales for a period, calculating your tax liability and other financial reports. Some popular gross sales calculators include those of the IRS, QuickBooks, and Xero.

Is it better to pay sales and use tax quarterly or yearly?

Most businesses must pay sales and use tax quarterly, although some states may allow annual payments. Often this will be met with Late Fees or Penalties. Please check with your local tax office.

What is a quarterly tax payment?

A quarterly tax payment is made to the government four times a year to cover income and sales tax liabilities you have created from making sales in your business. These payments are typically due on January 15, April 15, June 15, and September 15.

How do I calculate quarterly taxes?

To calculate quarterly taxes, you'll need to estimate your total income and tax liability for the quarter. Separating out taxable and non-taxable events. You will then need to adjust your number for FICA.

Who needs to pay quarterly taxes?

Most self-employed individuals, as well as those who expect to owe $1000 or more in tax after withholdings or credits, are required to pay quarterly taxes.

How many times a year do you pay quarterly taxes?

Quarterly taxes are typically due four times yearly, on January 15, April 15, June 15, and September 15.

How to log the checks my business receives?

To log the checks your business receives, you should create a record of each transaction that includes the date of the check, the amount, the check number, and the purpose of the payment. Somebody should store this information in your sales and use a log or a separate accounting system. In our Sales and Use Log, there is a column for the check number, and it's easy to add the client and location and even link your invoice or receipt to the log.

How do I track my business checks?

To track your business checks, you can create a separate ledger or spreadsheet that includes all incoming and outgoing checks, including details such as the date, check number, amount, and purpose of the payment.

How do I figure out my sales and use tax and FICA?

To figure out your sales and use tax, you can use a tax calculator or consult with a tax professional. To calculate your FICA taxes, you'll need to consider your Social Security and Medicare taxes, based on your income and set at a specific rate.

Do I have to pay quarterly taxes in my first year?

Yes, if you expect to owe $1,000 or more in tax for the year after deducting any withholding and credits, you must pay quarterly taxes even in your first year of business.

What Do I Need to Know Before I Purchase This Sales and Use Tax Log?

In what formats will I be able to get a document?

This product will be immediately available upon purchase as a digital download in any form you choose.

What are the Usage rights of this purchase?

You have unlimited private usage rights. Use it to your heart's content. Build on it, adjust it, make it your own. That said, we intend this document for the private use of your business venture. It cannot be shared, resold, or given in any form of intellectual transfer of information in some way created from this document beyond your private usage without the direct, written permission of Conscious Bean.

What's the Return Policy?

If this product doesn't meet your needs, we will return your original purchase price 100%. Disclaimer: This document is a tool. We do not intend the insights obtained as legal or financial advice. The creator and its constituents will not be held liable for any outcomes resulting from the material.